How much do horses cost? Here’s my answer for 2019.

Whew! When I began publishing horse expense reports a year ago, I wasn’t sure how the numbers would look a year later. I’m so glad I stuck with it. Now I have a much better idea what my horse costs, which levers I can pull to save money, and what to expect going into 2020.

The biggest benefit, though, was the accountability I felt to make smarter decisions about my spending.

As we look back on 2019, remember these reports are intended to be a tool for horse enthusiasts who are considering buying (or leasing) a horse and want a transparent look at the real cost of horse ownership.

(If you’re new, make sure to read the “reminders” section here for background on my finances.)

OK, let’s get into it!

2019 in a Nutshell

Until I started these reports, I’m ashamed to say I had little understanding of what my horse was costing me month-to-month. I swiped my credit card, wrote checks, and paid bills without pausing to really think about what I was doing.

As a responsible horse owner, it’s my job to watch the money and where it goes.

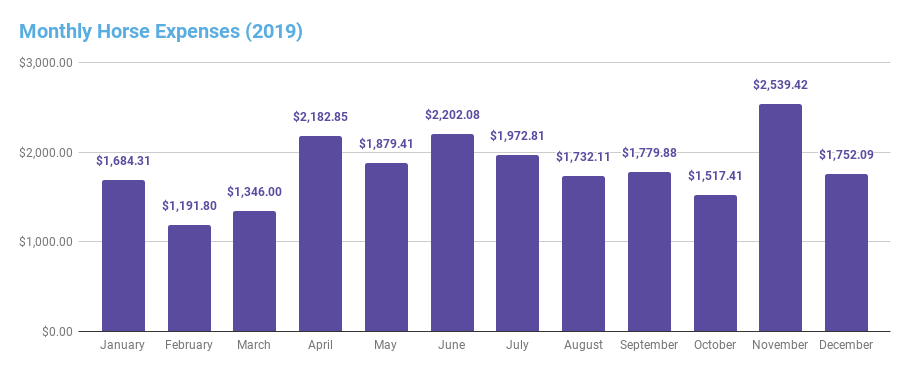

The chart below shows my monthly horse expenses — without taking any trades into account. In other words, this is the “actual value” of what I spent on my horse.

My most expensive month was November ($2,539.42) and least expensive month was February ($1,191.80).

January – December 2019

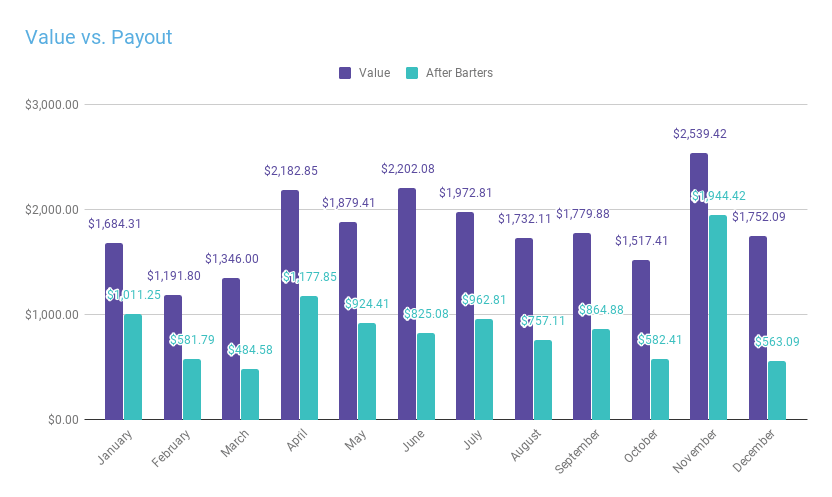

If you’ve been following along throughout the year, you know my goal is to spend $1,000 or less in out-of-pocket horse expenses each month.

As you can see from the chart below, I met that goal 9 of 12 months — a 75% success rate. Not too shabby!

Annually, I came in $110 under budget for each month, on average.

January – December 2019

Owning a horse as a single, self-employed person is challenging. That’s why I rely heavily on trades as much as possible, whether that’s bartering for marketing, clinic management, or social media services.

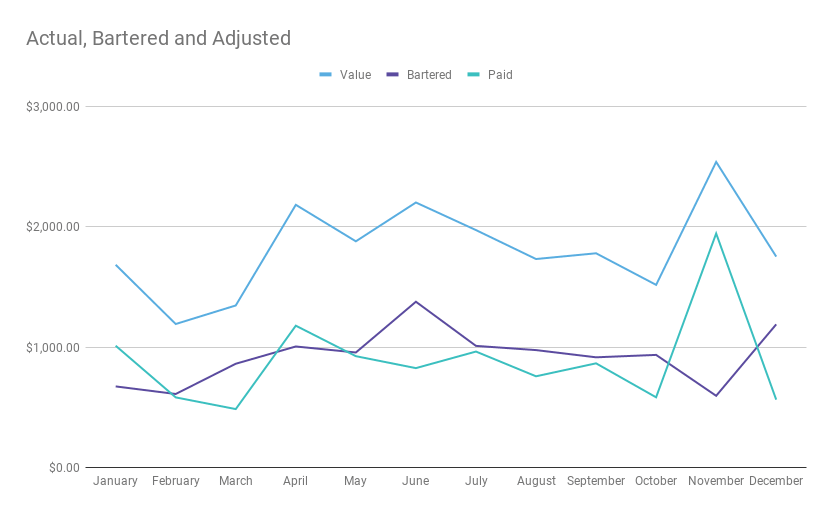

The chart below overlays the total value of expenses with what I bartered and ultimately paid out-of-pocket.

Without trades, I wouldn’t have met my budget even a single time last year.

January – December 2019

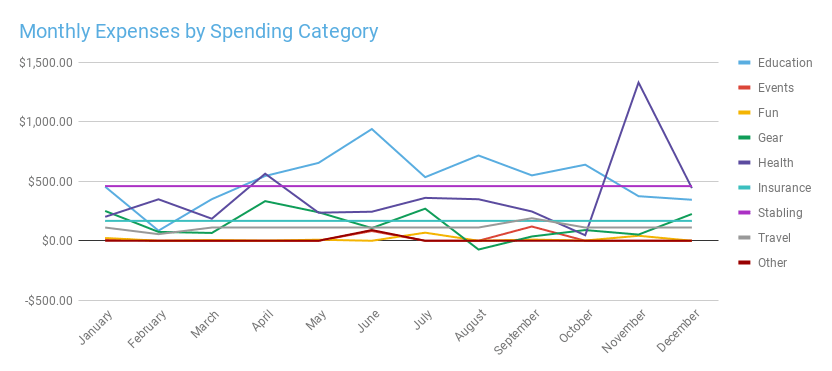

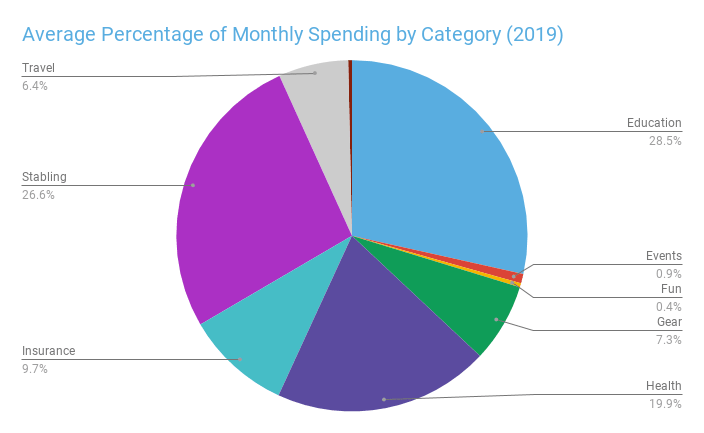

You may be wondering, where does all this money go anyway? I was too, so I tracked my spending across 9 categories.

The chart below shows the value of expenses by category throughout the year.

Education was the greatest portion of my annual spending at $6,192.50.

Runners up were stabling at $5,520 and health at $4,558.15.

January – December 2019

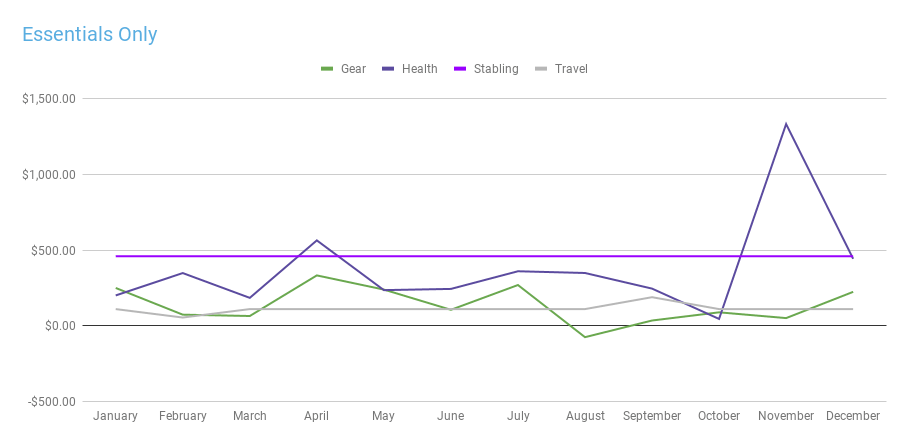

This all begs the question, do I really need to spend this much to own a horse? The short answer is no.

If I fell on hard times and needed to quickly reduce my horse-related spending, I could. The chart below shows what I would’ve spent if I only did “the essentials” — gear, health, stabling, and travel.

Theoretically, I could have lowered the annual value of my horse costs to $13,107.59.

January – December 2019

As you can tell from all the numbers, though, I place a high value on things like education (e.g. clinics, lessons). So a big piece of the pie goes to improving myself as a rider.

The chart below shows my 2019 annual spending by percentage/category.

Education is the biggest slice of the pie at 28.5%, closely followed by stabling at 26.6%.

January – December 2019

Now that you’ve got a better sense of the year in review, I’ll provide more context by spending category.

Cost of Owning a Horse Last Year

EDUCATION = $6,192.50

- At this point, I can only comfortably afford one horse. That means my gelding does 3 lessons per week across multiple disciplines like jumping, cross country,

dressage , reining, cutting, and ranch riding. That’s not counting additional rides I do on my own outside of lessons. - In order to offset my high educational expenses, I offered to take over our barn’s clinic management. That’s helped me pay for both lessons and board much of the year.

If you’re taking lessons (or about to start), check out our 13 best horseback riding boots for lessons.

HEALTH = $4,558.15

- I summarize spending in this category in a single word… ooof! I have a hard time saying no to any expense that *might* improve my horse’s health or comfort.

- From massages to chiropractic adjustments, supplements to hock injections, I just reach for my checkbook.

- Health expenses aren’t something I can currently trade for, so they can feel pretty heavy from time to time.

- I don’t spend much in this category, but I like having it there for the occasional splurge — like clinic photos.

EVENTS = $217.00

- Going to events isn’t usually my cup of tea either, so this these expenses were minimal.

- In 2020, I may do a few small schooling shows that boost this spending.

GEAR = $1,670.36

- Gear is a huge part of most equestrian budgets, and it’s no wonder why. There is SO much you can buy, and much of it is positioned as “necessary” by companies and fellow riders.

- The good news is that I’m much more intentional about buying gear since I’ll have to justify it in my expense reports 🙂

INSURANCE = $2,012.04

- Seeing this total was a rude awakening, but I suppose I shouldn’t be surprised. I have liability insurance, mortality, major medical, truck, trailer, and roadside assistance plans.

- I’m also not able to trade for any of my insurance costs, so this feels like a lot of money for something I have yet to use. Not even once. Then again, that’s the nature of horse insurance…

STABLING = $5,520.00

- This expense is consistent month-to-month, and my stabling cost includes my horse’s group paddock, turnout, deworming, and access to all our riding facilities.

- Being a boarder also entitles me to a discount on lessons, so that’s helpful.

TRAVEL = $1,359.08

- This figure is an average and is calculated by taking the IRS mileage rate for 2019 (58 cents) x 4 visits per week x 4 weeks per month.

OTHER = $90.00

- This catch-all category only had two entries last year — blanket cleaning and repairs.

TOTAL (Before Adjustments) = $21,780.17

GRAND TOTAL (After Adjustments) = $10,679.68(Under budget by $1,320.32)

Money Well Spent

What am I particularly glad I spent money on in 2019?

- Lessons: Though the cost is high, the reward is far higher. It’s always worth investing in knowledge and becoming a better rider.

- Farrier visits: Do I like spending so much on my horse’s shoeing every six weeks? No way. But, he stayed sound for all but a few days during 2019 — and that’s awesome. In the end, it’s worth it to get this health component right.

- Better stirrups: I improved my stirrup game big time in 2019. My Compositi Flex and Acavallo Arena stirrups have completely changed my sense of security while riding

dressage and jumping. - Custom tack: Investing in my custom western bridle and breast collar were great investments. My horse is more comfortable, and the pieces are so well made they should last for years.

- Custom chinks: These felt like an extravagance at the time, but now I don’t know how I rode for years without them. They give me so much more grip during my reining and cow work, and I can use them in future western shows.

Wonder how expensive horses are where you live? We break down the average horse cost in all 50 states.

Buyer’s Remorse

What do I regret spending money on in 2019?

- Truck and trailer: I struggle with this big time. I maybe use my truck and trailer for a dozen trips per year, which seems like such a waste. Then again, I don’t love the idea of asking friends give us a ride to events or the vet. Maintaining these vehicles, though, probably isn’t worth it for the amount I use them. I’m weighing whether to sell them in 2020.

- Insurance: I understand the point of horse insurance, of course, but it’s a tough thing to spend money on. Unless something goes wrong, you don’t get anything for your money. And $2,000 is a lot of money! That said, I’m too nervous not to have the policies I have.

Tips for Reining in Expenses (Pun Intended)

How could you save some money?

- Barter, barter, barter: Periodically trading for things like board and lessons helps lower my bills a lot. Bartering is what allows me to take 3 lessons per week and ride in so many clinics. If you want to get 7 ideas for how you can trade for some of your expenses, subscribe to our email list!

- Watch for price drops: If you have a product you use often, keep an eye out for sales on Amazon or in your local tack stores. Apps like Honey can help you do this automatically by applying coupon codes and checking prices for you. Click here to try Honey for free.

- Compare costs before you buy: Most of the time, I make my horse-related purchases on Amazon. I love the selection, 2-day Prime shipping, and competitive prices.

Financial unpredictability is part of the game with horse ownership, and you need to be prepared for expenses to fluctuate hundreds (or more) dollars each month. Looking back on all of my 2019 spending, I’m more aware than ever just how expensive horses are to own and why so many people find other ways to get their horse fixes.

Hope you enjoyed the past 12 months of expense reports. I’m excited to continue tracking my costs in 2020, so watch for January’s report soon.

Happy Trails!

P.S. If you hate buyer’s remorse too, check out our Horse Rookie Must Haves on Amazon for equestrian gear that’s worth every penny!

P.P.S. Buying your first horse? Check out 60 Questions to Ask When Buying the Horse of Your Dreams and our Beginner’s Guide to the Best Equine Insurance.

See More Expense ReportsEnjoy this article? Trot on over to:

- Horse Rookie’s Monthly Horse Expense Reports

- How Much Horses Cost & How Can You Afford One?

- Estimate Your Average Horse Cost (State by State)

- I Want a Horse But Can’t Afford One (Now What?)

- How to Ride & Show Horses Without a Trust Fund

- 7 Ways to Barter for Horse Expenses